free cash flow yield explained

During the past 3 years the average Free Cash Flow per Share Growth Rate was 2190 per year. Thats 2 the same as the bond.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Determining free cash flow and the different uses is a fantastic.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

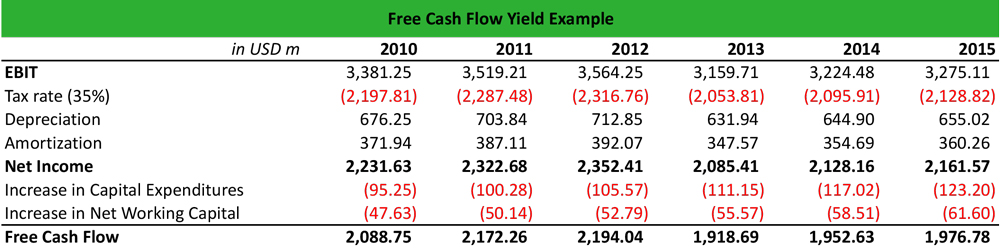

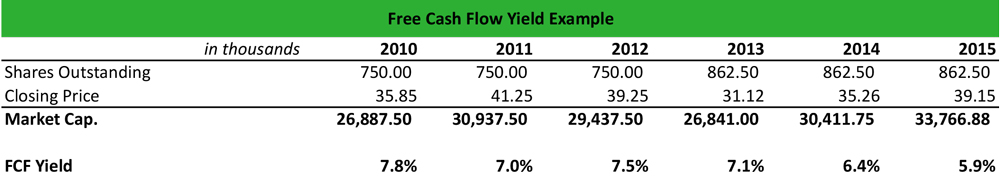

. This ratio expresses the percentage of money left over for shareholders compared to the price of the stock. Ad 93 of small business owners are constantly leaking money on useless and unnoticed things. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share.

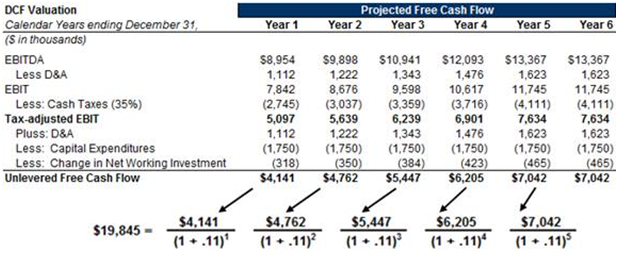

This report is an abridged version of All Cap Index Sectors. There are various ways to compute for FCF although they should all give the same results. The Free Cash Flow Yield Cash Flow Yield The free cash flow yield is a financial ratio that compares the free cash flow per share to the market price per share to determine how much cash flow the company has in the event of.

Free cash flow is really free cash available with the owners of the company. Return On Tangible Equity. The ratio of Free Cash Flow to a companys enterprise value FCF Enterprise Value.

Ad QuickBooks Financial Software. Most information needed to compute a companys FCF is on the cash flow statement. Free Cash Flow Yield Free Cash Flow Market Capitalization.

What is Free Cash Flow FCF. Although IRR and MoM often reign supreme as the most popular private equity return metrics Free Cash Flow Yield is also a very powerful investment metric. Free cash flow can be defined as a measure of financial performance calculated as operating cash flow minus capital expenditures.

And free cash flow can be distributed in the form of carry or dividends increasing the salary paid to private. Rated the 1 Accounting Solution. Free Cash Flow Uses.

It is computed as the product of the total number of outstanding shares and the price of each share. GYRO Free Cash Flow per Share as of today April 24 2022 is -1736. Free cash flow yield is really just the companys free cash flow divided by its market value.

In depth view into Gyrodyne LLC Free Cash Flow per Share explanation calculation historical data and more. We can use the FCF Yield to rank all stocks on an apples-to-apples basis. Free cash flow is a great tool to use for case study interviews and for returns analyses.

Beyond profit free. Using free cash flow yield to measure the sustainability of a company may produce potentially higher returns and more attractive upsidedownside capture overtime. Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118.

Heres the fun part. Free Cash Flow Yield FCFY We can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis. Though the company looks profitable in the PL account a negative FCF will yield it only zero intrinsic value.

The value investors like Warren Buffett will stay away from such companies. To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital. Free Cash Flow Yield The Best Fundamental Indicator Free Cash Flow Yield.

Free cash flow FCF is the cash flow available for the company to repay creditors or pay dividends and interest to investors. Alibaba free cash flow for the quarter ending September 30 2021 was 1077600 a year-over-year. During the past 12 months the average Free Cash Flow per Share Growth Rate of CVS Health was 1590 per year.

Free Cash Flow Yield Through 31122 one of. We can also compare the FCF Yields to bond yields. Free Cash Flow Operating Cash Flow CFO Capital Expenditures.

Its free cash flow per share for the trailing twelve months TTM ended in Dec. Amazon annualquarterly free cash flow history and growth rate from 2010 to 2021. Get 3 cash flow strategies to stop leaking overpaying and wasting your money.

The formula below is a simple and the most commonly used formula for levered free cash flow. Read more divided by its total free cash flow. Free cash flow can be defined as a measure of financial performance calculated as operating cash flow minus capital expenditures.

FCF Yield is the answer. Free Cash Flow Yield is a metric that measures how much free cash flow the company generated for investors relative to the price that investors have to pay to buy their stake. Free cash flow yield is a financial ratio which measures that how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per share with market price per share and indicates the level of cash flow company is going to earn against its market value of the share.

Stack of papers with title free cash flow FCF or free cash flow to firm FCFF. Free Cash Flow Yield. The free cash flow in this example is negative.

Alibaba free cash flow for the twelve months ending September 30 2021 was a year-over-year. When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model. Amazon free cash flow for the quarter ending December 31 2021 was -906900 a year-over-year.

One of the Most Important Metrics in Finance Free cash flow is the most important metric in finance. Free Cash Flow Yield Explained. Free Cash Flow Yield Finding Gushing Cash Flow for Future Growth Cash is king and free cash flow is the oil that runs the engine.

Of those using discounted free cash flow models FCFF models are.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Operating Cash Flow Ratio India Dictionary

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Meaning Examples What Is Fcf In Valuation

What Is Free Cash Flow Yield Definition Meaning Example

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Uses One Of The Most Important Metrics In Finance